July 01, 2025

Engineering Taxable Income: Applying the Tools Available as a Practice Owner

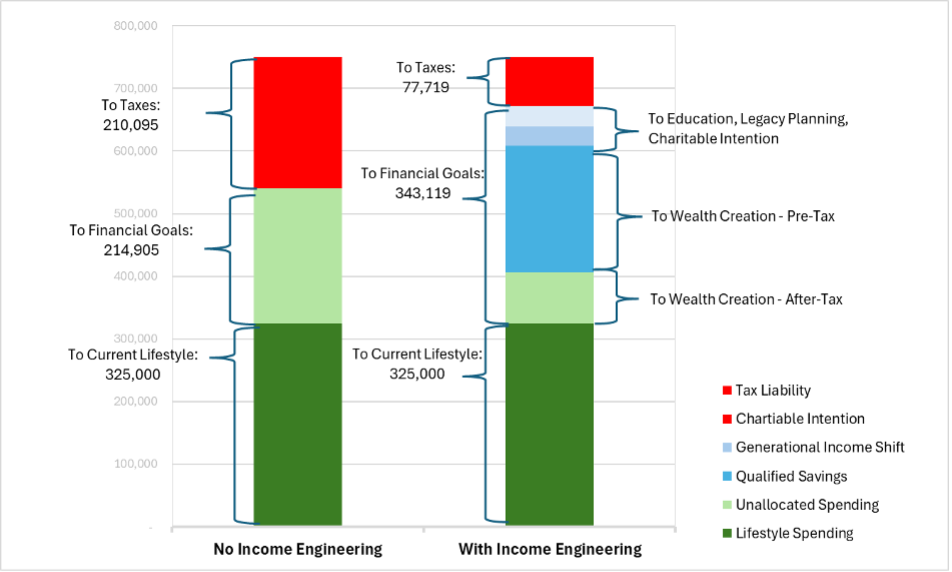

In our last blog, we discussed the tools available to you as a practice owner to engineer your profit and take control of your taxable income. Previously, we covered income recognition strategies, 401(k) plan basics, and the fundamentals of cash balance plans. In this article, we apply those tools through a case study to demonstrate the power of income engineering.

A sample situation highlighting the power of planning.

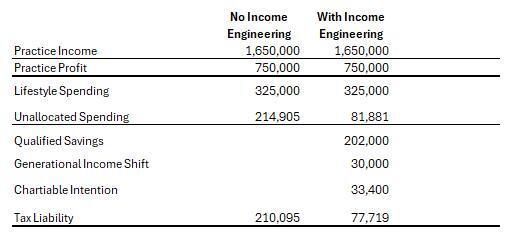

Let’s assume we have a practice owner and their spouse, both in their mid-50s, filing a joint return. The practice generates $750,000 in profit. For simplicity, we’ll assume they take the standard deduction and have no qualified retirement plans in place. For this case study, we are going to only look at federal income taxes at a high level; individual tax situations will vary and you should consult with your advisor and accountant.

Initially, the couple reports $150,000 in W-2 wages and $600,000 in pass-through income—well above their current lifestyle spending of $325,000 annually. With the $30,000 standard deduction, their taxable income is $720,000, placing them squarely in the 35% marginal tax bracket. Based on our tax planning software, their estimated tax liability in this scenario is $210,095, or 28% of practice profit.

Step 1: Increase W-2 wages to optimize qualified plans.

At $150,000, the W-2 salary may raise IRS questions around “reasonable compensation,” and it’s likely too low to fully optimize qualified plan contributions. Increasing wages to $250,000 provides better coverage on both fronts: protecting against scrutiny and enabling maximum contributions.

In this scenario:

• The owner defers $30,500 to a 401(k), including the catch-up contribution.

• Profit sharing contributions are maximized at $47,000.

• The practice funds a cash balance plan contribution of $94,000.

These moves generate $169,000 in total deductions.

Step 2: Put your spouse on the payroll.

The owner’s spouse has long supported the business—contributing marketing ideas, administrative help, and bookkeeping. It’s time to make it official. With a $35,000 annual salary, the spouse can also defer $30,500 into a 401(k) with catch-up.

Together, the owner and spouse defer a total of $202,000 out of their current 35% bracket. Their taxable income drops to $518,000, reducing their tax bill by $78,061, equivalent to 17.6% of practice profit.

Step 3: Employ your teenage children.

The couple’s two teenage children help with practice landscaping, trash removal, and light janitorial duties. They've also endured the embarrassment of appearing in local marketing campaigns. To compensate them, each child receives $15,000 in W-2 wages. With no other earned income, their standard deduction reduces their taxable income to zero.

Encouraged by their parents and the family’s wealth advisor, each child contributes $7,000 to a Roth IRA—growing tax-free for the future. Meanwhile, the couple continues to benefit from the standard deduction. Thanks to this strategy, they may be eligible for a modest qualified business income deduction (QBID), and taxable income is reduced to $487,851. The couple drops into the 32% tax bracket, saving an additional $11,297 and bringing their effective federal tax to 16.1% of practice profit.

Step 4: Invest in your practice.

After assessing the cost of repairing aging medical equipment—and considering lost productivity and integration benefits—the couple decides to upgrade. They finance $150,000 in new equipment.

Given the prior reductions to taxable income and the long-term nature of the equipment, their accountant and wealth advisor recommend claiming 40% bonus depreciation in 2025. This results in an additional $60,000 deduction.

Step 5: Give back to the community.

The couple has always been charitably inclined. This year they decide to combine that with raising their practice’s visibility. They sponsor their favorite charity’s annual gala at a cost of $35,900. With proper structuring, the payment qualifies as a qualified sponsorship payment—allowing both the practice and the charity to have a tax-efficient outcome. The couple also retains their full-standard deduction on the personal side.

The final outcome.

After incorporating all of these moves—and claiming the standard deduction—the couple reduces their pre-QBID taxable income to $394,600, which allows them to capture the full 20% QBID. Adjusting for increased W-2 wages, deductions, and depreciation, the remaining pass-through income is $200,600. Staying within the phaseout range allows them to claim the full $40,120 QBID. This reduces their final taxable income to $354,480, placing them in the 24% marginal tax bracket. Based on our Holistaplan software, the resulting federal tax liability is $77,719—just 10.4% of practice profit. Combined, this strategic approach saves the owners $132,376 in federal taxes.

As you can see, thoughtful and strategic planning allowed this couple to keep more money in their pocket by reducing their federal tax liability. If you have questions about engineering taxable income, our team would love to help you. Schedule a conversation with a practice integration advisor today!

Source: https://www.irs.gov/newsroom/irs-releases-tax-inflation-adjustments-for-tax-year-2025

Category

Business OwnershipContent Topics

About the Author

Thomas Bodin

Practice Integration Advisor & Team Leader