March 06, 2025

Monthly Investment Commentary: March 2025

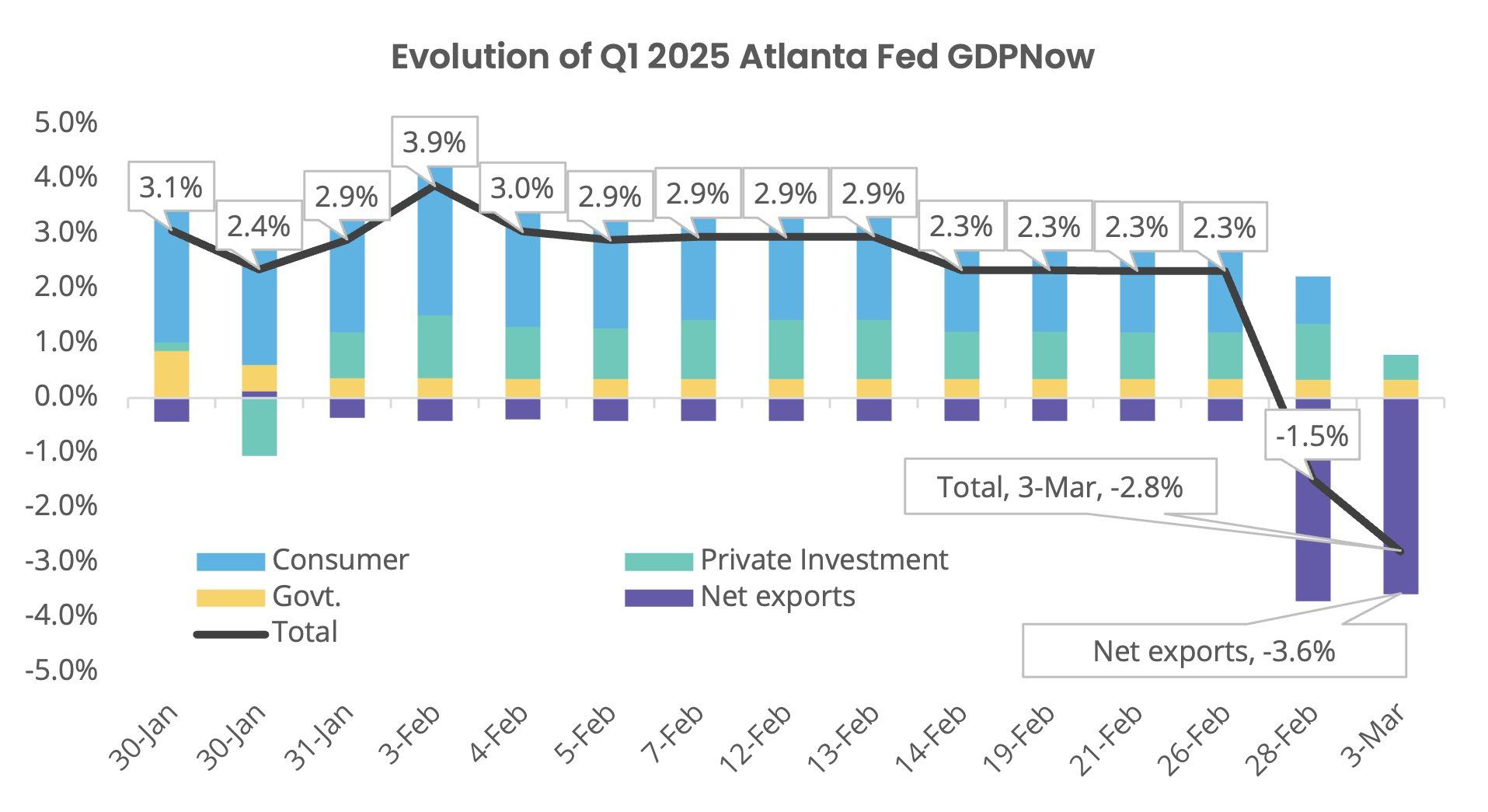

The Atlanta Fed’s forecast for first-quarter GDP plunged from a 2.3% increase to a 2.8% contraction after a sharp 26% jump in the trade deficit. While recent economic data warrants closer scrutiny, we see balanced risks and advise staying near long-term targets. Despite federal cost-cutting concerns, private sector growth could help stave off a recession.

The Atlanta Fed’s GDPNow economic tracker recently swung sharply as new trade estimates from the Census Bureau rolled in. The impact was dramatic, swinging the indicator for first-quarter U.S. GDP growth from a relatively solid 2.3% to a 2.8% contraction. The primary culprit was an astounding 26% increase in the trade deficit over the last month as imports surged.

Despite this news, we do not believe the indicator’s reading portends an imminent recession in the U.S. The tracker has a history of overreactions as it extrapolates real-time data into longer-term trends with incomplete information. Low unemployment and rising incomes suggest that the consumer has the capacity to spend. In addition, the advance trade data that is responsible for the decline can be volatile and, we believe, easily explained.

What’s GDP?

It’s helpful to have a brief macroeconomics refresher to understand what's happening. A country's gross domestic product (GDP) can be estimated by summing expenditures across three main categories: consumers, private investments (equipment, intellectual property, real property, inventories, etc.), and government. In addition, because a country’s consumers and government might buy and sell goods and services internationally, we also must add/subtract the country’s trade balance (the sum of exports minus imports).

Data Source: Atlanta Federal Reserve

Why Focus on Trade?

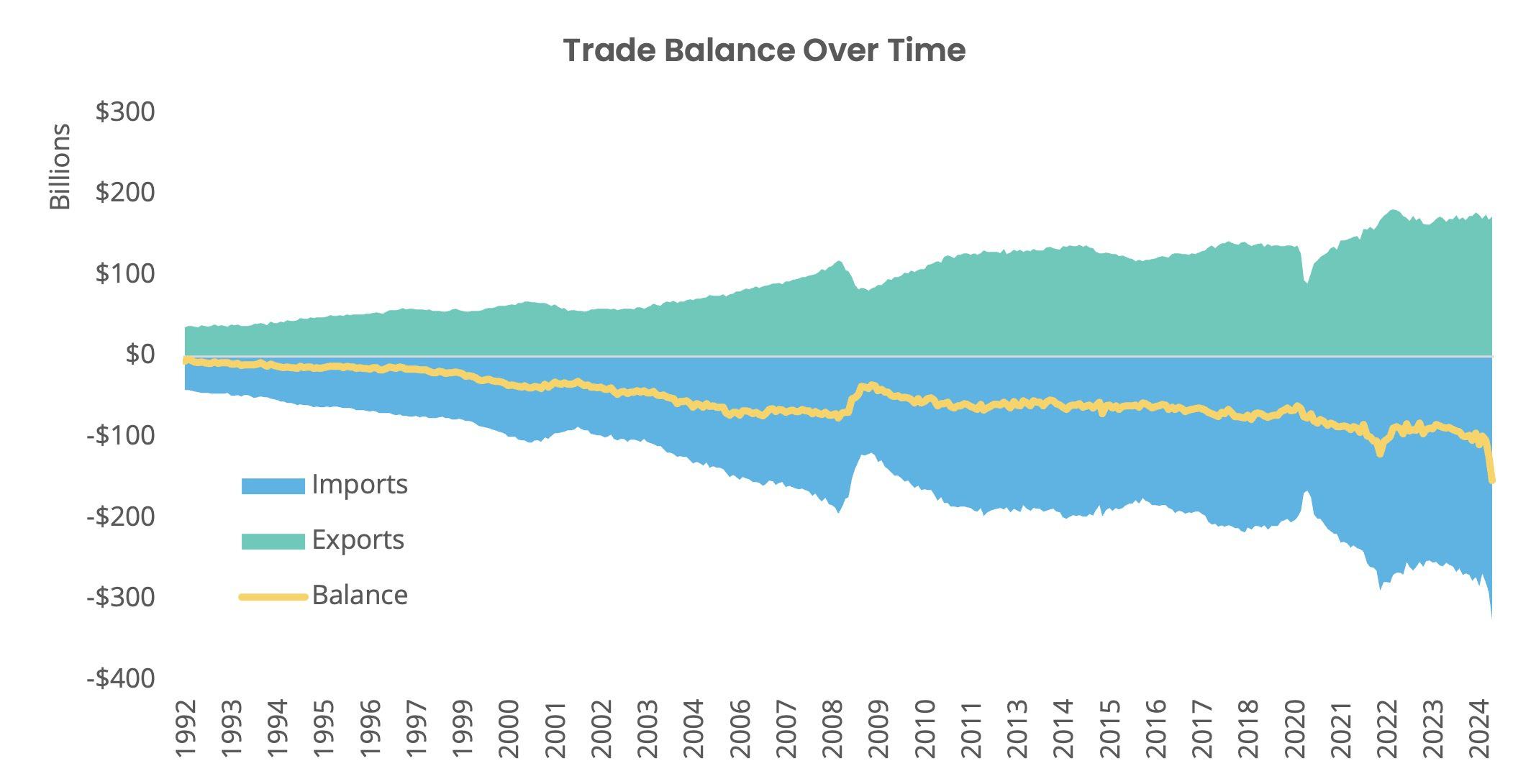

The last part of the formula often causes political consternation, as many investors assume that it’s always better for exports to be higher than imports because it is additive to GDP, rather than subtracting from it. What this superficial analysis ignores, however, is the opportunity cost of producing one good or service versus another. Many imported goods and services are inputs into more valuable domestically produced goods and services. If the goods and services are cheaper to produce internationally, a country’s profits—and, therefore, GDP—can actually be higher by buying rather than producing them. This exercise illustrates the concept of comparative advantage, first introduced by economist David Ricardo. His theory shows that countries should import goods that another country can make cheaper or better so that the first country can allocate resources toward higher value-added goods. This serves to increase a country's per capita income. We find it notable that U.S. exports and imports generally mirror each other over time, and the few instances of significant reductions have been during periods of U.S. recession.

Data Source: U.S. Census Bureau, Advance U.S. International Trade in Goods

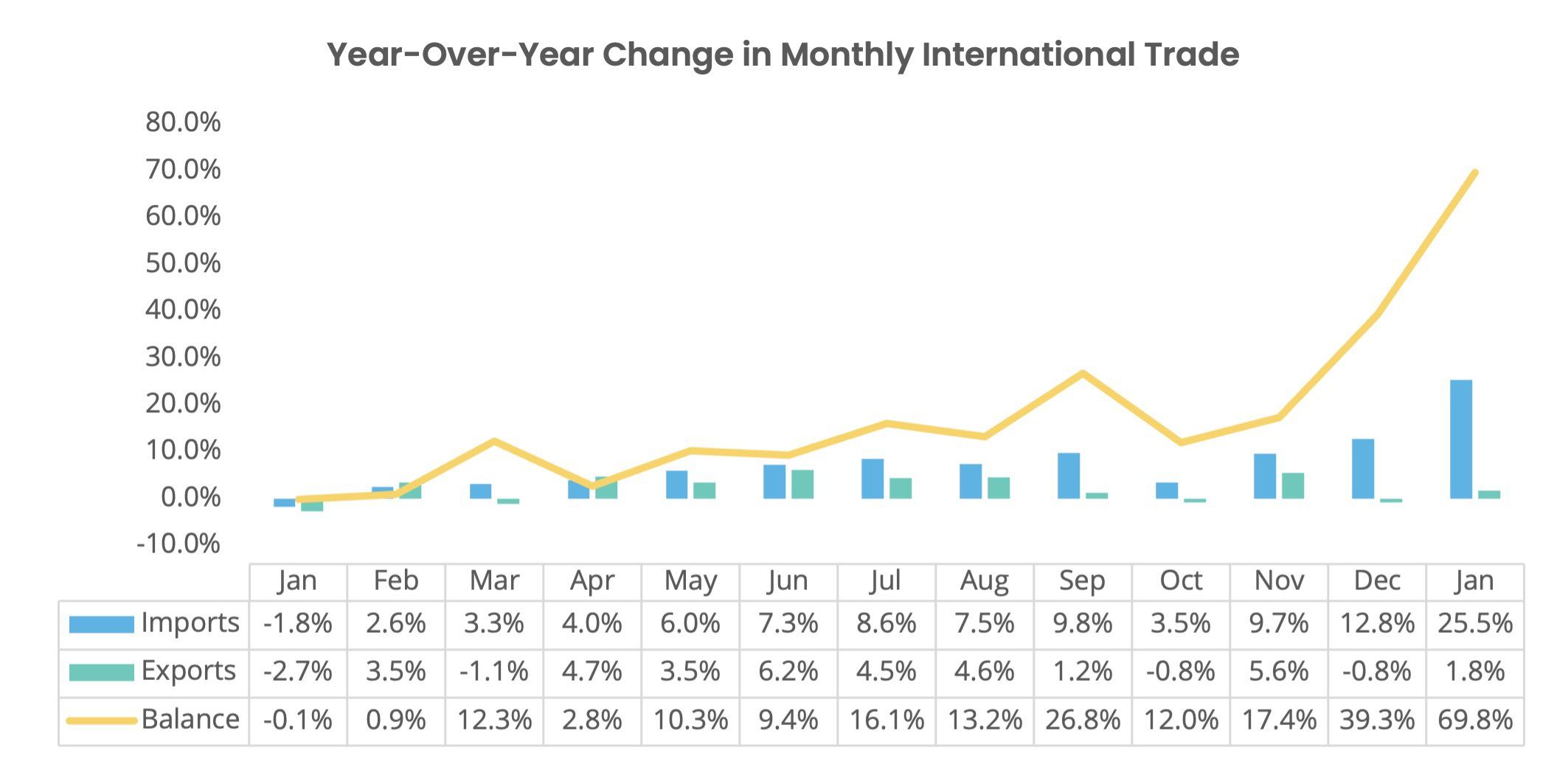

According to the Census Bureau, U.S. imports grew an estimated 11.9% in February, the second-highest monthly rate since 1992. The highest was in July 2020, as the global economy reopened after months of lockdowns. The year-over-year growth rate of 25.5% is even more remarkable, with the trade balance growing by almost 70% over the last 12 months. It begs the question—where did this influx of imports go?

Data Source: U.S. Census Bureau, Advance U.S. International Trade in Goods

Imports can go toward one of three places: consumer spending, business investment, and government spending. We suspect the recent spike in imports was driven by business investment. As the business community evolves from “just in time” inventory management to help improve efficiency to “just in case” manufacturing designed to cushion the blow of supply chain disruptions, inventories have become one of the more volatile elements of GDP. One way for companies to insulate themselves against the threat of future tariffs is to pull forward their purchasing—buying a $1 part today that might cost $1.25 sometime later would generate an excellent return on investment. This hypothesis aligns with the rapid increase in import spending since the election.

What About Government Spending?

One area that could be a headwind to GDP growth is reductions in federal spending. Commerce Secretary Howard Lutnick has suggested that government spending should be reported separately from the official U.S. GDP figures. While that may make for better headlines, economists and investors will likely add it back as they do when companies try to include or exclude certain items in their earnings statements. Federal spending represents approximately a quarter of U.S. GDP, and the federal workforce includes approximately three million employees (not including those who work for federal contractors or state and local workers who rely on federally funded programs). To date, the newly created Department of Government Efficiency (DOGE) estimates that it has saved $105 billion, or about 0.36% of U.S. GDP.

More pressing is the threat that the government halts all but essential services later this month. Congress has until March 14 to pass legislation to keep the government funded to prevent a shutdown. Prediction markets currently show a 54% chance that the government will shut down at some point this year. In terms of how a government shutdown may affect markets, the short answer is that there is no historical correlation between government shutdowns and market returns.

Government shutdowns have occurred more than 20 times since 1976. A prolonged shutdown can noticeably impact GDP, but the effects tend not to be long-lasting. Vanguard calculated the return on the S&P 500 during the past 21 government shutdowns. The range of historical outcomes is wide: from down 4.4% in an 11-day shutdown in 1979 to up 9.3% in the shutdown that began in December 2018 and ended in January 2019.

How Should Investors be Positioned?

We believe the risks are balanced, and investors should stay near their long-term targets. The recent economic data requires more scrutiny. We must look past the headline numbers and examine the trends. Moreover, the recent data does not reflect the pro-growth agenda that President Trump and Congress have promised to deliver over the coming months. While we are monitoring the labor market for signs that the recent federal cost-cutting is causing pain, we believe that private sector growth will keep the U.S. out of recession territory for now.

Download the Monthly Investment Commentary.

Sources: Atlanta Federal Reserve, U.S. Census Bureau, Department of Government Efficiency, Kalshi, and Vanguard

Services are offered through Focus Partners Wealth, LLC (“Focus Partners”), an SEC registered investment adviser with offices throughout the country. The information provided is educational and general in nature and is not intended to be, nor should it be construed as, specific investment, tax, or legal advice. Individuals should seek advice from their wealth advisor or other advisors before undertaking actions in response to the matters discussed. No client or prospective should assume the above information serves as the receipt of, or substitute for, personalized individual advice.

This reflects the opinions of Focus Partners or its representatives, may contain forward-looking statements, and presents information that may change. Nothing contained in this communication may be relied upon as a guarantee, promise, assurance, or representation as to the future. Past performance does not guarantee future results. Market conditions can vary widely overtime, and certain market and economic events having a positive impact on performance may not repeat themselves. Investing involves risk, including, but not limited to, loss of principal. Focus Partners’ opinions may change over time due to market conditions and other factors. Numerous representatives of Focus Partners may provide investment philosophies, strategies, or market opinions that vary. The appropriateness of a particular investment or strategy will depend on an investor’s individual circumstances and objectives.

This is prepared using third party sources. Focus Partners considers these sources to be reliable; however, it cannot guarantee the accuracy or completeness of the information received. Focus Partners does not undertake an obligation to update the information herein at any time after the date of publication.

© 2025 Focus Partners Wealth, LLC. All rights reserved. RO-25-429114

Category

InvestingContent Topics

About the Author

Jason Blackwell

Chief Investment Strategist